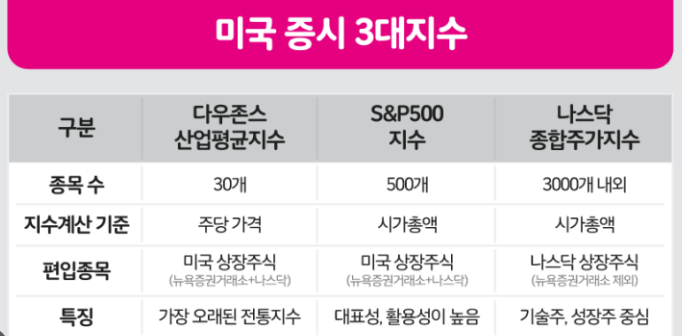

✅ S&P 500·나스닥·다우존스 2% 이상 상승✅ 연준(Fed) 금리 정책 변화 기대감 상승✅ 반도체·기술주 강세, 투자 전략은?📌 미국 증시 폭등! 지금이 투자 기회인가?미국 증시가 강력한 반등을 보였습니다.S&P 500, 나스닥, 다우존스 모두 2% 이상 상승하며 글로벌 증시에도 긍정적인 신호를 주고 있습니다.과연 이번 상승이 지속될 수 있을까요? 그리고 투자자들은 어떤 전략을 세워야 할까요? 🧐🚀 미국 증시 상승 배경 (왜 올랐을까?)1️⃣ 연준(Fed) 금리 인하 기대감최근 발표된 경제 지표가 예상보다 긍정적 → 금리 동결 또는 인하 가능성↑투자자들은 연준의 정책 변화에 따라 시장이 긍정적으로 반응2️⃣ 기술주·반도체 업종 강세엔비디아(NVIDIA), 애플, 마이크로소프트 상승AI(인공지능..